The scramble to capture Spanish-speaking newspaper readers in the United States is about to get another combatant, led by two experienced foreign correspondents who worked most recently at The Wall Street Journal.

The new venture, Meximerica Media, is expected to announce in the next few weeks that it intends to create Spanish-language, tabloid-size newspapers in several Texas cities, according to several people briefed on the plans. Among the cities under strong consideration are Austin, Houston and San Antonio, to be followed by others in the West and Southwest where Mexican-American readers are thought to be underserved.

The newspapers being conceived by Meximerica are but the latest burst of entrepreneurial activity aimed at Spanish-speaking readers, particularly by mainstream media companies like the Tribune Company, Knight Ridder, the Belo Corporation and MediaNews Group. In just the last year, six Spanish-language daily newspapers have been started in cities like Chicago and Los Angeles, while at least seven Spanish-language weeklies have begun publishing, including in relatively new Hispanic communities in Iowa, North Carolina and South Dakota.

These efforts are intended to capitalize on one main trend - the burgeoning Hispanic population in the United States, as documented in the 2000 Census - and to compensate for another - the sluggish readership and advertising market for mainstream, English-language newspapers.

But newspaper industry analysts cautioned that the quest for Spanish-speaking readers is a complicated one, particularly for any media company that perceives the nation's nearly 40 million Hispanic Americans as monolithic. Such companies, if they move too quickly, also risk being viewed as interlopers who could alienate the very readers they are trying to reach.

Those readers are "very sophisticated, and they're very much in tune with their countries of origin," said Kirk Whisler, the president of the Latino Print Network, a research and marketing affiliate of the National Association of Hispanic Publications. "And in the case of Mexico, it's their state of origin."

"Just the fact that you throw in coverage of Mexico - and in your market there may be four states in Mexico that 80 or 90 percent of the residents are from - is not enough," Mr. Whisler added. "You need that localized news. That's really what they want to see."

The Meximerica newspapers plan to do just that, according to one person briefed on the plans, featuring local news, dispatches from the Mexican news wires, the latest Mexican soccer results and profiles of Latino entertainment figures.

Meximerica is led by Edward Schumacher, a former managing editor of The Wall Street Journal Americas and a former correspondent in Madrid and Buenos Aires for The New York Times; and Jonathan Friedland, who, until recently, was the Los Angeles bureau chief for The Journal and a former correspondent in Buenos Aires and Mexico City. Mr. Friedland's resignation, and his hiring as group managing editor of Meximerica, were announced in a memo sent late last month to the news staff of The Wall Street Journal, which is owned by Dow Jones & Company, by Paul E. Steiger, the newspaper's managing editor. (Citing the memo, The Los Angeles Business Journal reported on March 29 on Mr. Friedland's departure for Meximerica.)

Both Mr. Schumacher, who was born in Colombia to a Panamanian father and Colombian mother, and Mr. Friedland declined comment on Meximerica

Before formally announcing the company's plans, Mr. Schumacher is believed to be seeking to secure more than $20 million from several investors, who are identified on the company's Web site only as "institutional backers in the U.S and Mexico."

Some larger newspaper companies have already invested heavily in the Spanish-language market. The Tribune Company, which owns The Los Angeles Times and The Chicago Tribune, has expanded its Hoy franchise from New York to Chicago and Los Angeles. Belo, the publisher of The Dallas Morning News, began Al Dia in Dallas. Knight Ridder, owner of The Fort Worth Star-Telegram, expanded Diario La Estrella in Fort Worth from a weekly to a daily.

And MediaNews Group, the owner of papers including The Denver Post and The Los Angeles Daily News, has turned the tabloid El Economico into the weekly Impacto USA.

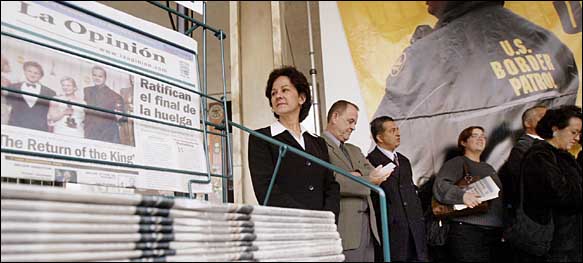

Meanwhile, already existing alliances have also undergone significant shifts. The Lozano family, which has published La Opinión, the Spanish language daily in Los Angeles, since 1926, announced in January the end of its partnership with Tribune, a relationship Tribune had assumed upon buying the Times Mirror newspapers in 2000. The Lozanos have since formed a venture, Impremedia, with CPK Media, the publisher of El Diario/La Prensa, the 91-year-old Spanish-language daily in New York.

Driving all this maneuvering, in large part, is the lure of advertising revenue. According to the Latino Print Network, the more than 650 Spanish-language newspapers in this country - including 40 that publish daily and 304 that publish weekly - earned an estimated $854 million in combined advertising revenue in 2003. That represents an industrywide increase of $743 million, or 670 percent, since 1990, and $258 million, or 43 percent, since 2000.

Over the same period, the readership of Spanish-language daily newspapers has grown - from 440,000 in 1990 (when there were 14 such publications) to 1.4 million in 2000 (when there were 34) to 1.8 million last year, according to the Latino Print Network.

That there is more than one way to approach such readers is apparent in the different strategies of the Lozanos and Tribune.

In seeking to replicate the success of Hoy, which was founded in 1998 and has an average daily circulation of nearly 94,000 in the New York metropolitan region, Tribune has created virtual clones - each also called Hoy - in Chicago and Los Angeles in recent months. While the tabloid-size newspapers share the same national news pages - and often the same front page - each also has its own newsroom with its own focus. Each day, for example, there are an average of two pages each devoted to Puerto Rico and the Dominican Republic in the New York edition, and four pages related to Mexico in the California editions (a total of four such editions, each pegged to a different zone of the Los Angeles area.)

"We want to be a national, easily identified brand with strong local roots in the community we're trying to serve,'' said Louis Sito, publisher, president and chief executive of Hoy and vice president for Hispanic media for Tribune.

By contrast, in joining forces with the publisher of El Diario, the chief competitor of Hoy in New York, the Lozano family has sought to maintain each newspaper's individuality - while still making it easier for advertisers to buy space in each. Neither publication, for example, will change its name, in part because each has worked for decades to build a loyal readership. El Diario has an average weekday circulation of nearly 50,000, while La Opinión averaged 125,000, during the six months that ended Sept. 30, according to the Audit Bureau of Circulations.

The formation of Impremedia, and the release in Los Angeles of Hoy on March 1, has touched off a fierce newspaper war - waged on billboards and over the radio and by dozens of hawkers.

Monica Lozano, the publisher and chief executive of La Opinión and a senior vice president of Impremedia, said that her family's long history in the Spanish language market set it apart from some newcomers.

"They've moved into the Spanish-language publishing field because they're now aware of the marketing potential, the advertising potential and the need to expand on their newspaper base,'' she said. "Ours is a commitment to publishing excellent Spanish-language newspapers that stand alone.''

Meximerica, has veered away from such battlegrounds, and instead focused on so-called "second tier'' markets where there is little or no competition.

In the San Antonio and Austin markets, for example, where there are an estimated one million and 344,000 Hispanic residents, respectively, there is no other Spanish-language daily, Mr. Whisler, of the Latino Print Network, said.

While many factors - not least the quality of the reporting and writing - will determine the success of Meximerica's publications, Mr. Whisler said he will be watching closely to see how long the company is willing to wait to build its readership, and how hard it is willing to work to understand what those readers are seeking in a newspaper.

"If you go in thinking you're going to make a ton of money, you're going to be disappointed,'' he said. "You may be doing very well on the ad sales right off the bat. But if you're not doing the things to build up that community involvement, you may not have the readership to continue delivering.''

----------

----------